Record revealed

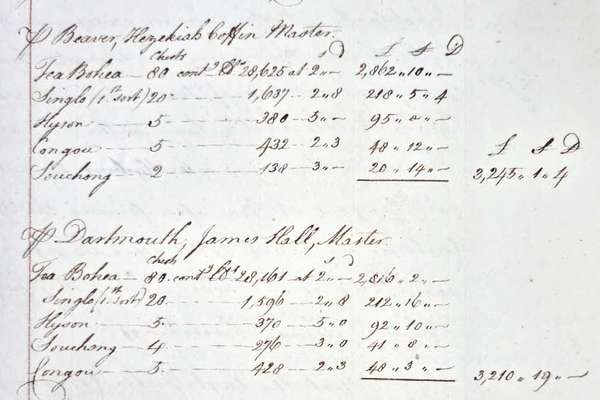

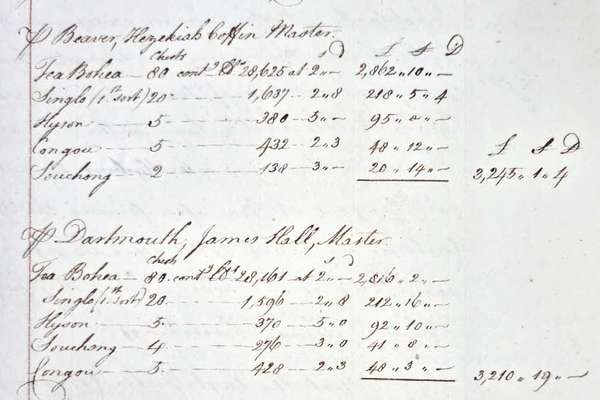

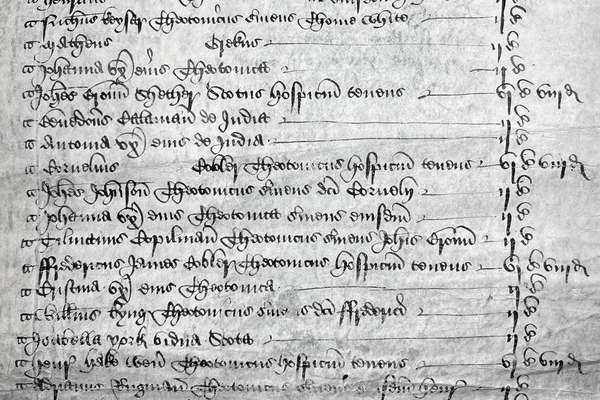

Request for compensation for the Boston Tea Party

Series

Catalogue reference: IR 16

IR 16

Abstracts and statements of tax on land, property and income and Inhabited House Duty, etc., for the United Kingdom, compiled from returns made by Surveyors of Taxes. These are records of the Chief Inspector of Taxes' Office. Later records are of...

Abstracts and statements of tax on land, property and income and Inhabited House Duty, etc., for the United Kingdom, compiled from returns made by Surveyors of Taxes. These are records of the Chief Inspector of Taxes' Office. Later records are of the Statistics and Intelligence Branch (later Division) dealing with surveys of personal income.

Records of the Statistics and Intelligence Division are also in IR 64

From 2025 HM Revenue and Customs

Income Tax Assessments (1845-1912) are as follows:

Schedule A: Income from the ownership of lands, tenements, hereditaments or heritages in the United Kingdom

Schedule B: Income from the occupation of lands, tenements, hereditaments and heritages in the United Kingdom

Schedule C: Interest, annuities, dividends and shares of annuities payable out of public revenue.

Schedule D: Profits or gains from any property, profession, trade, employment or vocation arising or accruing to any resident of the United Kingdom; profits or gains arising or accruing to any non-resident of the United Kingdom from any property etc. in the United Kingdom, and for and in respect of all interest of money, annuities and other annual profits and gains not charged by virtue of any of the other Schedules.

Schedule E: Public offices or employments of profit; annuities, pensions or stipends payable by the Crown or out of the public revenue of the United Kingdom, except annuities charged under Schedule C.

Assessed Taxes (1845-1912) are as follows:

Schedule B: Inhabited House Duty

Schedule C: Servants

Schedule D: Carriages

Schedule E: Horses for Riding

Schedule F: Other Horses and Mules

Schedule G: Dogs

Schedule H: Horse Dealers

Schedule I: Hair Powder

Schedule K: Armorial Bearings

Board of Inland Revenue: Chief Inspector's Office and Statistics and Intelligence Division: Tax Abstracts and Statistics

Read stories that share a catalogue subject with this record.

Record revealed

Focus on

Record revealed

Records that share similar topics with this record.