Record revealed

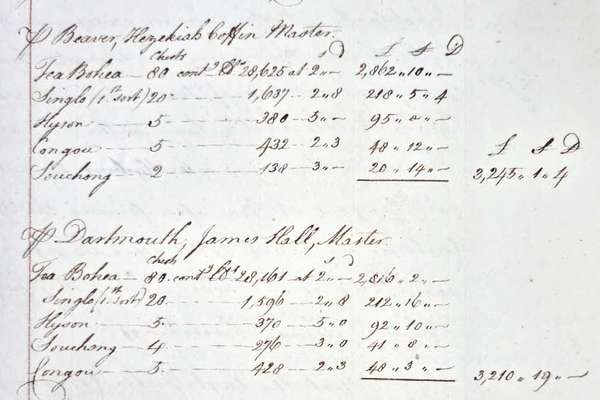

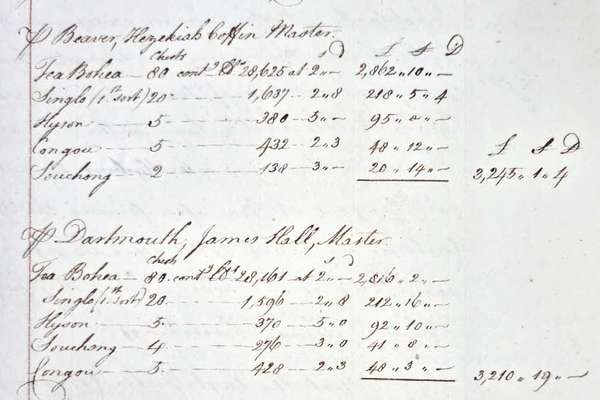

Request for compensation for the Boston Tea Party

Division

Catalogue reference: Division within IR

Division within IR

Records relating to the administration of land tax redemption. Registers are in IR 8, with registers of redemption certificates in IR 24. Enrolment books of deeds and assignments are in IR 20. Parish books of redemptions are in IR 22....

Records relating to the administration of land tax redemption.

Registers are in IR 8, with registers of redemption certificates in IR 24. Enrolment books of deeds and assignments are in IR 20. Parish books of redemptions are in IR 22. Exonerations are in IR 21, with quotas and assessments in IR 23, and miscellanea in IR 25.

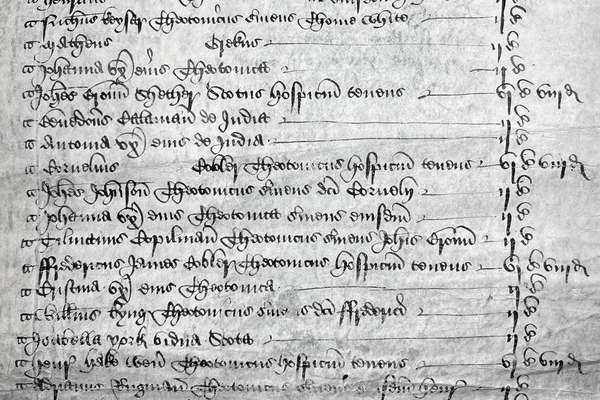

The land tax, based on a valuation made under taxation legislation of 1692, was voted annually from that date until 1798, when the amount voted for that year was made a perpetual charge, subject to redemption or purchase. A series of Acts beginning in 1806 authorised the exoneration of land tax charged upon lands and buildings belonging to ecclesiastical and charitable institutions with an income under £150 per annum, subject to a maximum in one year of £6000. Those benefiting from this procedure were required to transmit a memorial describing fully the exonerated property and a certificate of redemption signed by two of the Land Tax Commissioners for the appropriate district.

Business relating to redemption and purchase of land tax, as well as all business relating to sales, mortgages or grants under the Land Tax Acts, was executed for the Board by a Land Tax Redemption Office, under the superintendence of a Registrar of Land Tax. The terms of redemptions varied over the years, and by 1950 stood at twenty-five times the annual assessment. The Finance Act 1949 introduced compulsory redemption in certain circumstances, such as when property changed hands, from 1 April 1950. The Finance Act 1963 abolished all unredeemed land tax with effect from 25 March of that year.

Records of the Boards of Stamps, Taxes, Excise, Stamps and Taxes, and Inland Revenue

Land Tax Redemption records

Record revealed

Focus on

Record revealed

Records that share similar topics with this record.